The Artist Invoice Template is an editable document that gives those that sell art a useful and straightforward means of billing for their creations, some of which may include paintings, prints, molds, sculptures, sketches, and digital art. To further simplify the invoice, both the PDF and Excel versions calculate all amounts and totals, leaving the Artist to focus more on the things that matter most.

Before an invoice can be issued, the artwork will need to be priced. An important fact to remember is that there’s no “correct” price – art is worth what someone will pay for it. While this information shouldn’t be used to justify charging a ridiculously high price in hopes that someone will bite, at the same time, the art shouldn’t be devalued because of emotions either.

Keep in mind the following points when pricing art:

If the above points are kept in mind, the artist will be well on their way to formulating a fair and accurate price. Below is a brief guide on completing the invoice in both PDF and Word.

Step 1 – Download

Download the Artist Invoice in either PDF, WORD, or Google Sheets.

Step 2 – Artist / Company Info

In the header area, enter the studio or artist’s name followed by the artist’s contact information to the right.

Step 3 – Client Info

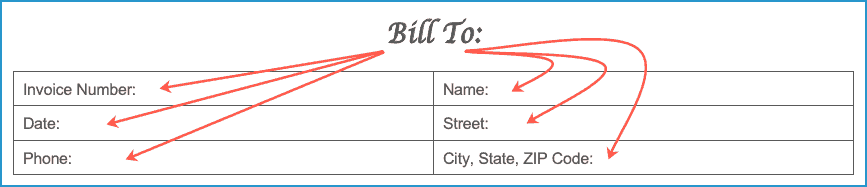

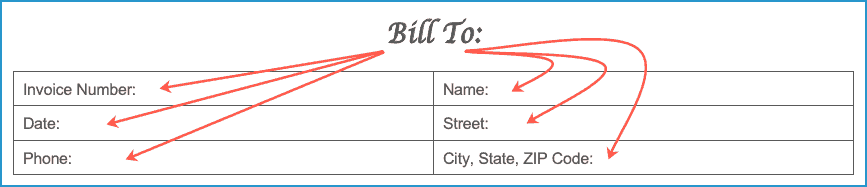

Under ‘Bill To,’ enter the following information:

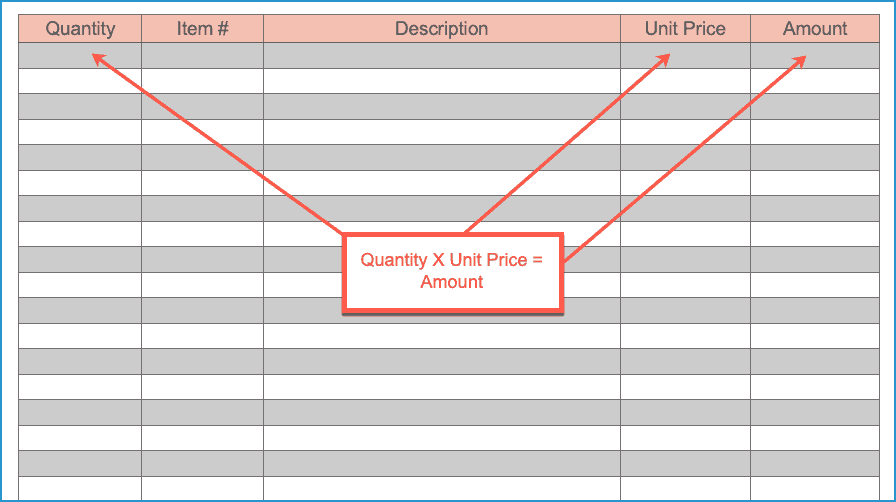

Step 4 – Products Purchased

Next, enter the items sold to the client. Start with how many of each item, the item # (if applicable), a brief item description, and finally the price per item. The PDF version will find the ‘Amount’ value automatically. If using the Word version, multiply the quantity by the item price for each row.

Step 5 – Totals and Comments

Enter any Sales Tax and add to the Subtotal to find the Total invoice amount. In the bottom header area, enter any comments for the buyer of the art such as an address to send the check or a personal thank-you. Finish the invoice by entering the number of days the buyer has to pay the invoice by.